- AF Weekly

- Posts

- Nvidia’s Bid To Stop Huawei

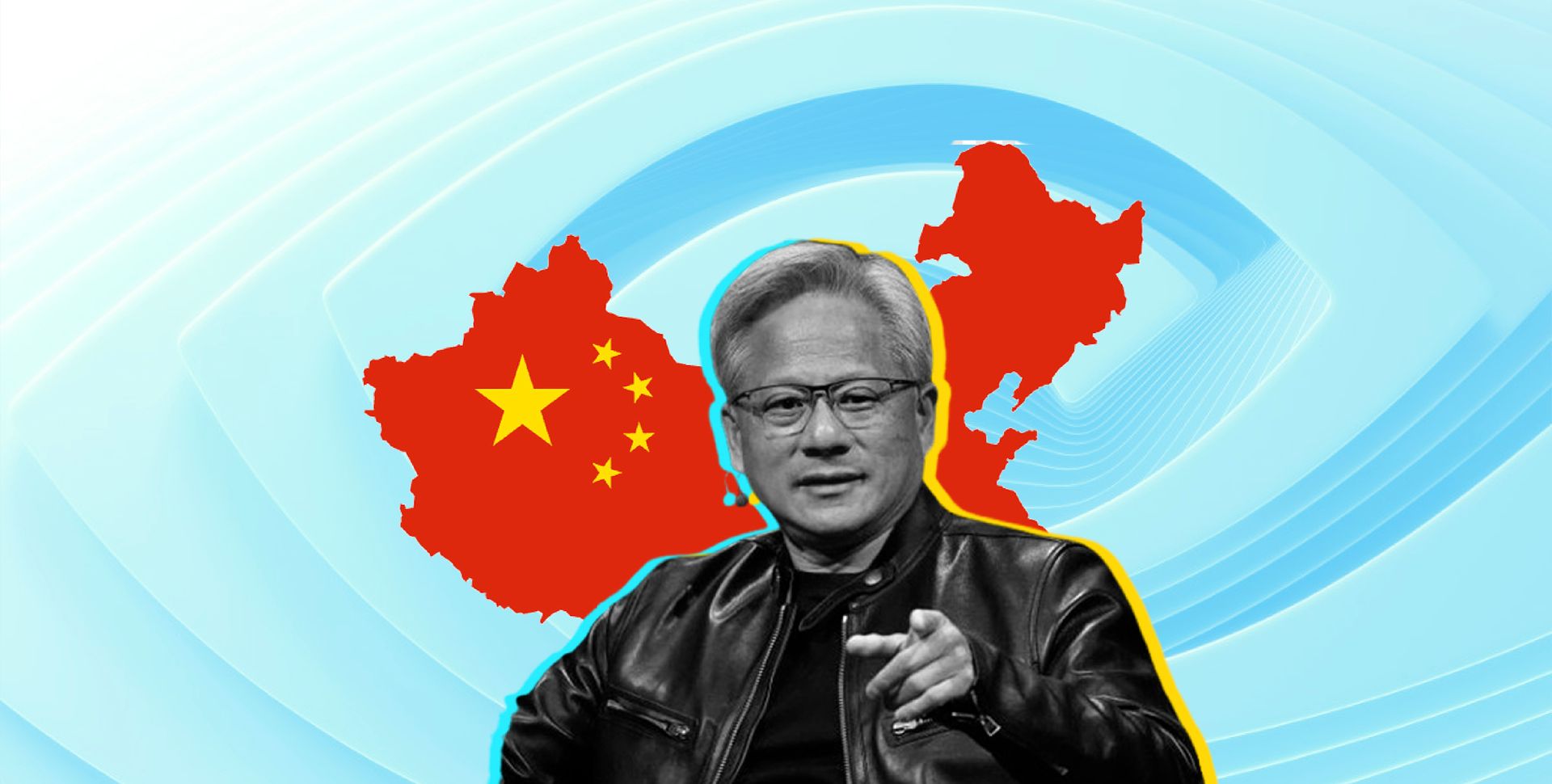

Nvidia’s Bid To Stop Huawei

Nvidia’s potential return to China has sparked off a frenzied focus on the billions the chip giant stands to earn. But many — including the firm’s CEO — argue the move has a far more important objective: slowing Huawei’s R&D juggernaut and preventing it from potentially dominating a $50 billion market

Graphic by Aarushi Agrawal for Asia Financial

In the often unpredictable saga of the US-China rivalry, this week brought with it a few more twists that no one could’ve seen coming: a chink in their bitter, three-year-long chip war and the CEO of the world’s most valuable company turning into an ‘unofficial envoy’ between the world’s two biggest superpowers.

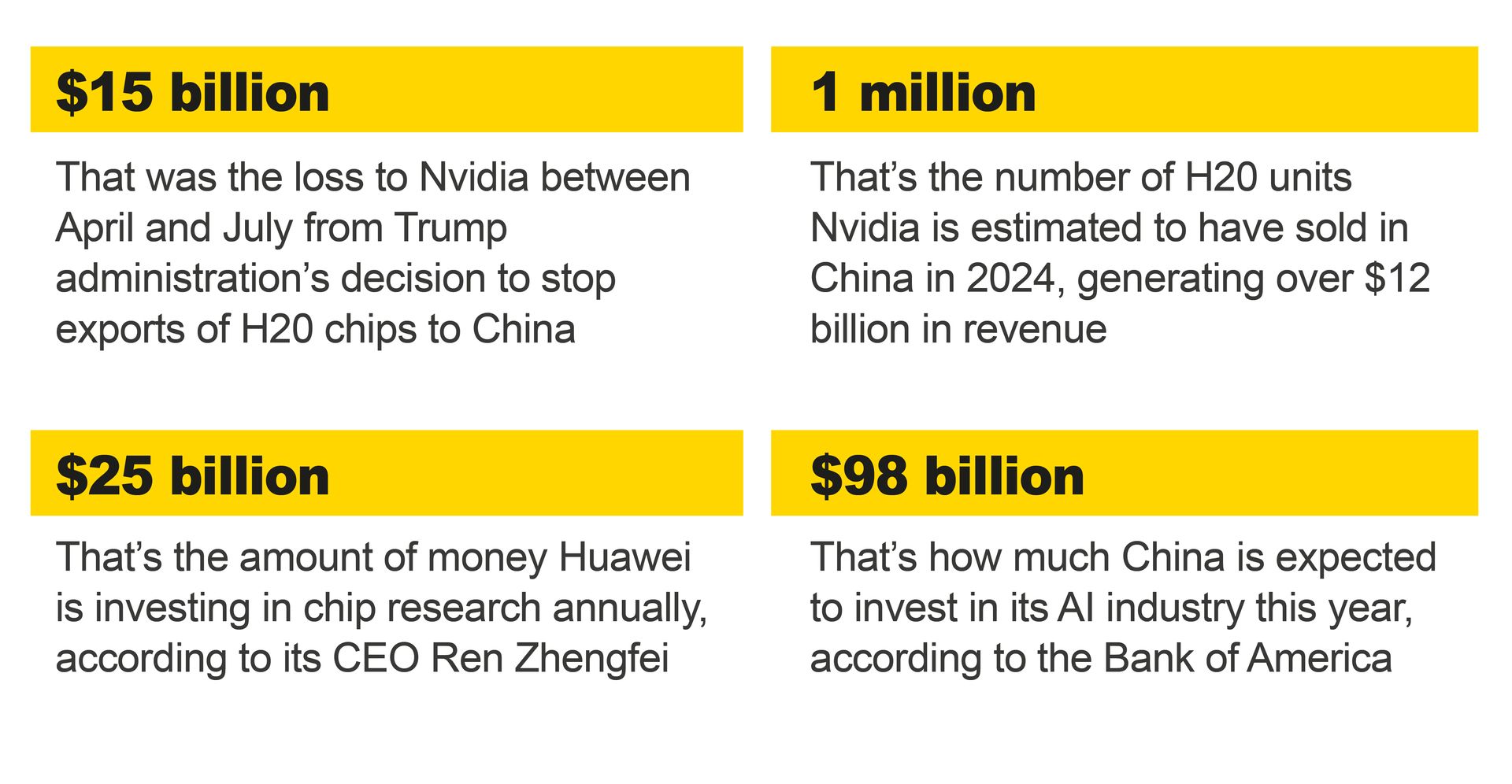

That’s what happened when Jensen Huang announced this week that his chipmaker Nvidia would begin selling its H20 artificial intelligence processors to China again. The Donald Trump administration had banned Chinese exports of the H20 chips only three months ago and effectively cut Nvidia off from the Chinese market.

On Wednesday, Huang also said he was hoping to sell even more advanced chips to China “because technology is always moving on”.

Naturally, Huang’s announcement stirred up a frenzy among Nvidia’s investors who have been wringing their hands about the world’s most valuable company being cut-off from the world’s biggest consumer of chips. Some analysts immediately raised price projections for Nvidia stock whose market capitalisation already surpasses the GDPs of countries like India, the UK, Brazil and Canada. Others predicted the company could see a $15 to $20 billion bump in revenues this year from its sales to China alone.

And some others coronated Huang as ‘America Inc’s new China envoy’. For someone who reportedly once considered government affairs as ‘trivial’ matters, Huang seems to have slid into the role seamlessly. By various accounts, Huang has spent the last few months lobbying White House to re-think its export control tactics, all while making friends with Trump’s allies and buying million-dollar dinners at the president’s Mar-a-Lago club. Meanwhile, he has also been a frequent flier to China, where he is currently on his third trip and signing autographs on the back of his fans’ leather jackets like a bonafide rockstar.

And he’s doing all that while treading a very delicate and unstable line between his two most important markets. That means that one, he’s handing all credit for the reversal on H20 chips to Trump, and two, he’s doing his very best to pump up Beijing by heaping praises on everything ranging from China’s “exceptional” ability to make humanoid robots and the “incredible technology” and “beautiful design” of its electric vehicles to its “miracle” supply chains and "world-class” AI.

But as you look closely into everything Huang has been saying, a larger picture emerges: Concern on China’s determination to grow its tech ability by hook or by crook, and the role of one company, in particular, in reaching that goal — Huawei Technologies.

For the uninitiated, Huawei was once the world's biggest telecom equipment-maker but its business decimated after the US sanctioned it in 2019 citing concerns over its links with the authoritarian Chinese Communist Party government. At one point, the company’s chief told its employees that Huawei was simply looking to survive, and yet, just a year later, it launched a surprise smartphone powered by China’s first ‘homegrown’ 7nm chipset.

And Huawei has not looked back since.

It is currently leading China’s push to become self-sufficient in the production of AI chips and is the only firm with any potential to rival Nvidia in the country. In just three years, Huawei has managed to significantly expand its chipmaking ability — by introducing new processors and overall computing offerings and by rapidly expanding its chip facilities. That’s not to disregard that Huawei is still far behind a behemoth like Nvidia or that the scale of its achievements has only been made possible by billions of dollars worth of funding from the Xi Jinping government.

But it also means that a continued absence of Nvidia from China will give Huawei unfettered access to the country’s $50 billion AI chip market.

| Meanwhile, in other news, the US’ Wells Fargo Bank has suspended travel to China after a senior bank official was blocked from leaving the country. |

|

Images via Reuters | And the world’s top producer of advanced AI chips, TSMC, says its profits hit historic levels after a 60% jump in the June quarter. |

A rock and a hard place

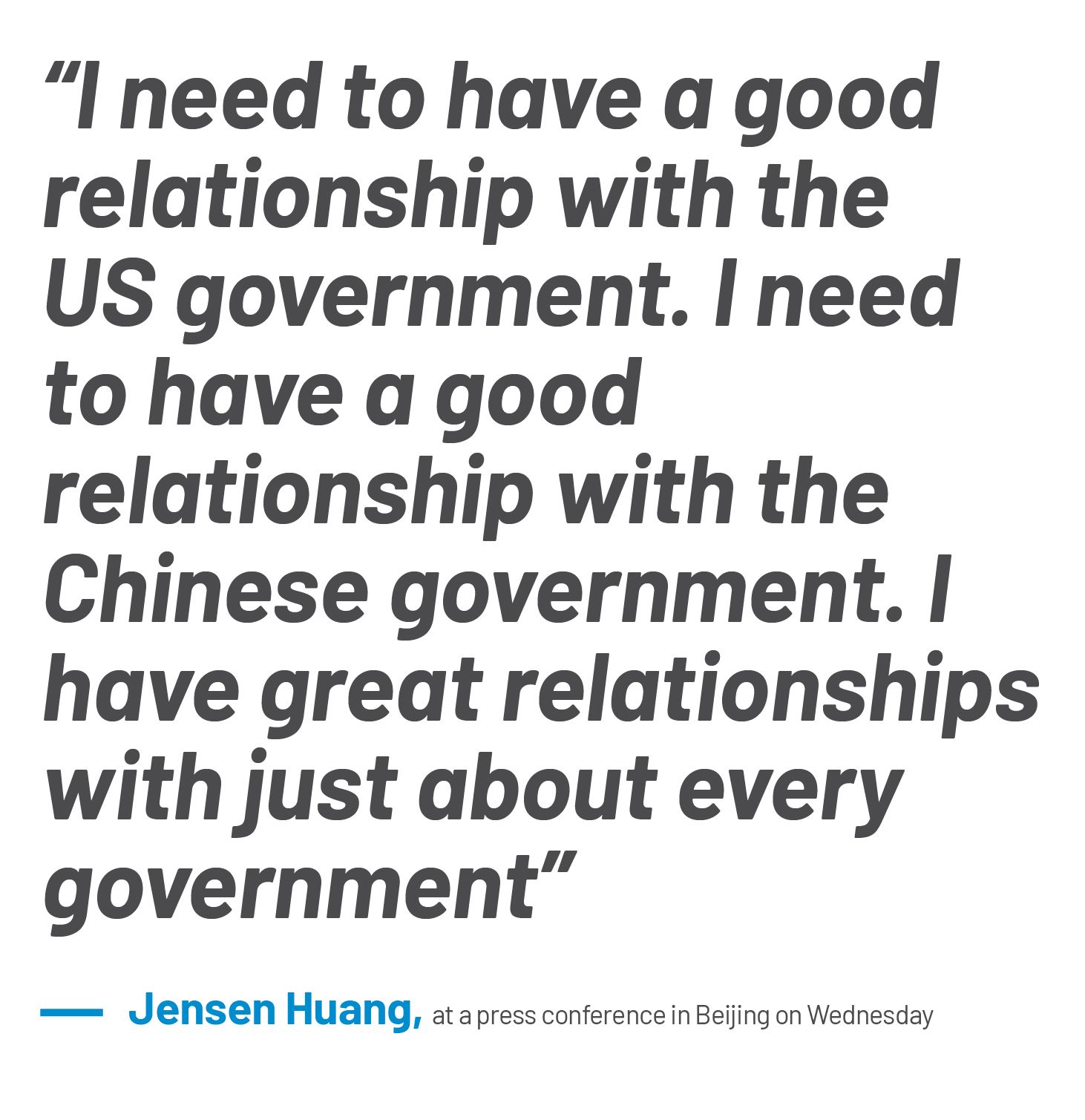

Nvidia’s Huang has not minced words on his concerns about Huawei. Speaking to reporters in Beijing this week Huang said it was “just a matter of time” before Huawei begins convincing developers in and outside of China to switch over to its AI chip systems. “The important thing to realise (is) I’ve been doing this for 30 years, they’ve been doing it for a few, and so the fact they’re already on the dance floor tells you something about how formidable they are,” he said.

Nvidia has previously named Huawei as its top competitor in making AI chips. And in Beijing this week, Huang reiterated that concern saying Huawei had "China covered" if US firms couldn’t participate in the market. Anyone believing otherwise was “deeply naive”, he said.

Huang is not alone in worrying about Huawei’s growth. Silicon Valley investor David Sacks, who is close to Trump and has been Huang’s ally in the push to return to China, said in an interview this week that it wouldn’t make sense to “hand Huawei the entire Chinese market” when Nvidia can grab a significant chunk of it even with its less advanced chips. It’s worth noting that Huawei has struggled to produce its Ascend AI chips at the scale that Chinese tech giants need and that the performance of those chips has left a lot to be desired.

Still, Patrick Moorhead, the chief of Moor Insights & Strategy, which counts Nvidia as its client, argued in a column in Forbes magazine that continuing chip export restrictions “risk enabling Huawei to build its own AI “Belt and Road” in Asia and beyond”. “History shows Huawei’s ability to become a juggernaut across different areas of tech,” he wrote.

The concerns outlined by Moorhead are already playing out in some parts of the world. Huawei, for instance, is attempting to export small amounts of AI chips to the Middle East where a deal secured by Trump continues to be fogged by national-security concerns. It is also looking to secure similar deals in Southeast Asia.

But on the other side of these arguments are legitimate concerns about China’s alleged bad faith practices ranging from smuggling in banned chips and even purchasing them through shell companies, to its firms like Tencent allegedly using H20 chips to create supercomputers, which is a violation of US sanctions. Experts such as those at Washington-based Institute for Progress also note that the H20 chips are actually far better than Nvidia’s more premium alternatives at running inference — the process by which AI models use their existing data to make predictions or decisions based on new data. Inference is currently one of the most coveted processes in AI and was the key to the success of China’s breakthrough DeepSeek R1 model.

In effect, these pro and cons would put US in a tricky place when it comes to Nvidia’s ambitious plan to sell to China. Neither the White House nor Trump have made any official comments with regards to Huang’s announcement on H20 chips and several US lawmakers have strongly criticised the move already. Meanwhile, Commerce Secretary Howard Lutnick has said that the H20 chip sales are part of US negotiations with China on rare earths. Separately, he also told CNBC that he’s okay with China getting Nvidia’s ‘fourth best’ chip as he wants Chinese companies to “get addicted” to American technology.

Whether or not H20 sales to China truly resume, however, remains to be seen considering Trump has been quick to change course on a volley of policies so far. What is clear, however, is that the choices before the US are complicated as hell: Does it take the risk of selling its coveted AI technology to China or give Huawei the opportunity to innovate, grow and dominate China’s AI market that has the potential to reach $140 billion in value by 2030?

Key Numbers 💣️

Sustain-It 🌿

Speaking of China, officials say climate change-related extreme weather has caused the country economic losses of at least 51 billion yuan ($7.12 billion) in the first half of this year. The most destructive disasters included a powerful earthquake that rocked Tibet and serious flooding in southern regions and landslides in southwestern provinces. More than 23 million people were affected, with 307 killed or missing, and 620,000 people having to undertake emergency evacuations, they say.

The Big Quote

“Every yuan of AI spending that goes to Nvidia is a yuan that doesn’t go to Huawei to reinvest into R&D, create better AGI [artificial general intelligence] sooner and spread it around the world.”

Also On Our Radar

India’s leading state think tank has proposed easing rules that have ‘delayed some big deals’ as they require scrutiny for Chinese investments.

China has vowed to contain “irrational” competition in its electric vehicle industry by monitoring prices and increasing probes into vehicle costs.

Indonesia is paying a high price for its trade deal with Trump by opening up its market to the US and still facing a 19% tariff on exports.

And regulators are planning to prohibit companies connecting underwater communication cables to the US if they include Chinese equipment or technology.