- AF Weekly

- Posts

- How US Visa Hikes Can Benefit India

How US Visa Hikes Can Benefit India

While Indian techies face growing uncertainty in the United States, they are also poised to benefit from a potential shift of American technology services to India

Graphic by Aarushi Agrawal for Asia Financial

Tesla’s Elon Musk, Microsoft’s Satya Nadella, Google’s Sundar Pichai, Zoom’s Eric Yuan, Coursera’s Andrew Ng. Aside from being some of the biggest names in the United States’ technology industry, there’s one other thing these guys have in common: they all once held an H-1B visa.

In the US today that visa has become near synonymous with immigrating Indian techies, and a larger symbol of a flawed system that replaces local US talent with younger, and sometimes, cheaper labour. But beyond that rhetoric lies the illustrious story of the rise of the American technology industry — one that many say could become India’s story now that the Donald Trump administration has committed to making a “significant number of changes” to the visa programme.

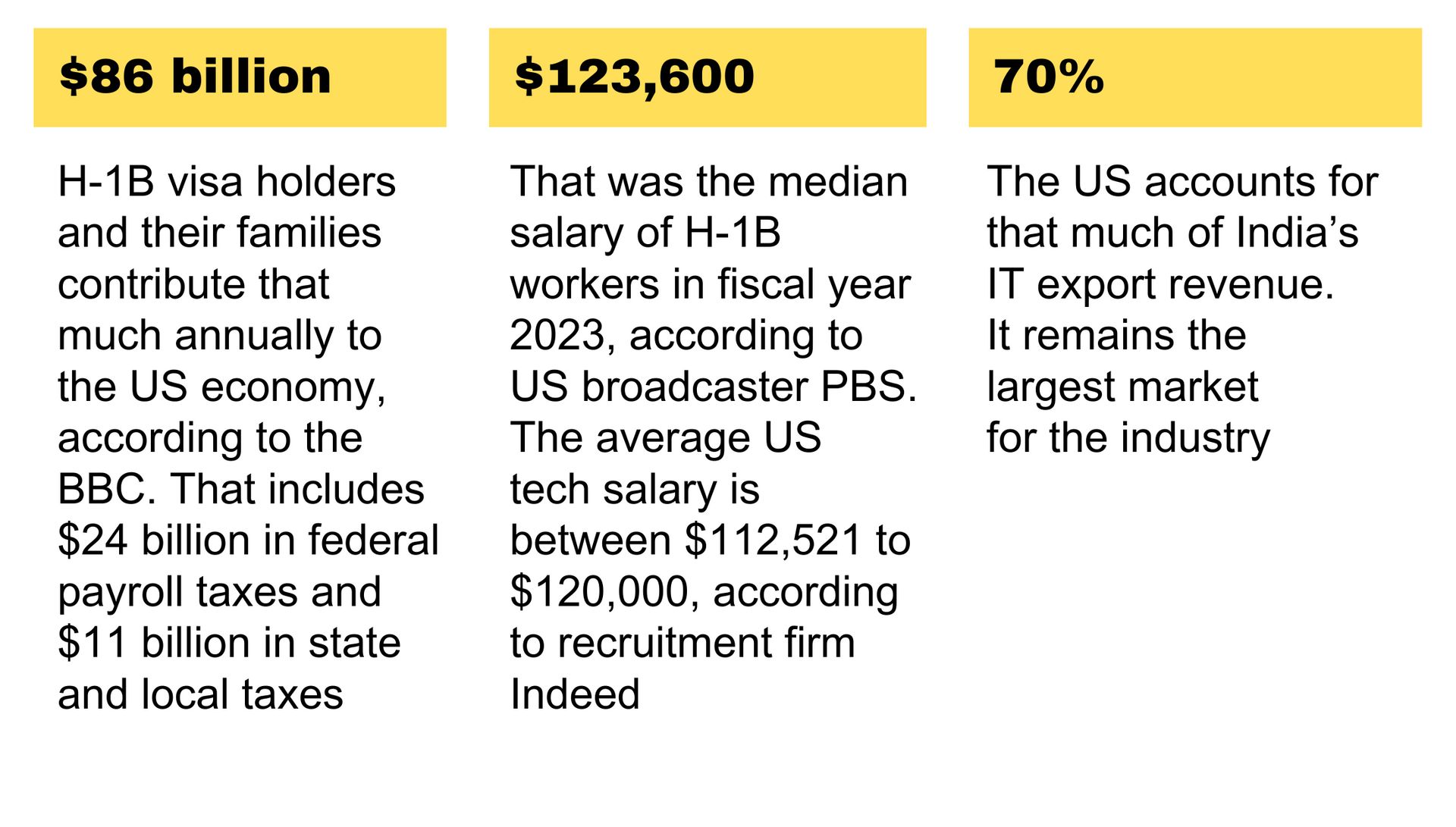

A key part of that overhaul was the $100,000 fee that the Trump administration has now implemented on new H-1B visas. The fee is payable by the companies that employ H-1B workers and some of the tech industry’s biggest names have warned that the exorbitant number could hurt American innovation and tech growth.

Chipmaker Nvidia’s Taiwan-born chief Jensen Huang, for instance, pointed out that while the new fee was "a great start" to tamp down on the legitimate abuse of the visa programme, it "probably sets the bar a little too high”. “It might accelerate investment outside the United States,” he added.

Huang is not alone in that assessment. Economists and industry insiders expect American companies to shift much of their critical work to — ironically — India, as uncertainty around the H-1B programme worsens if Trump officials like Howard Lutnick keep their promise.

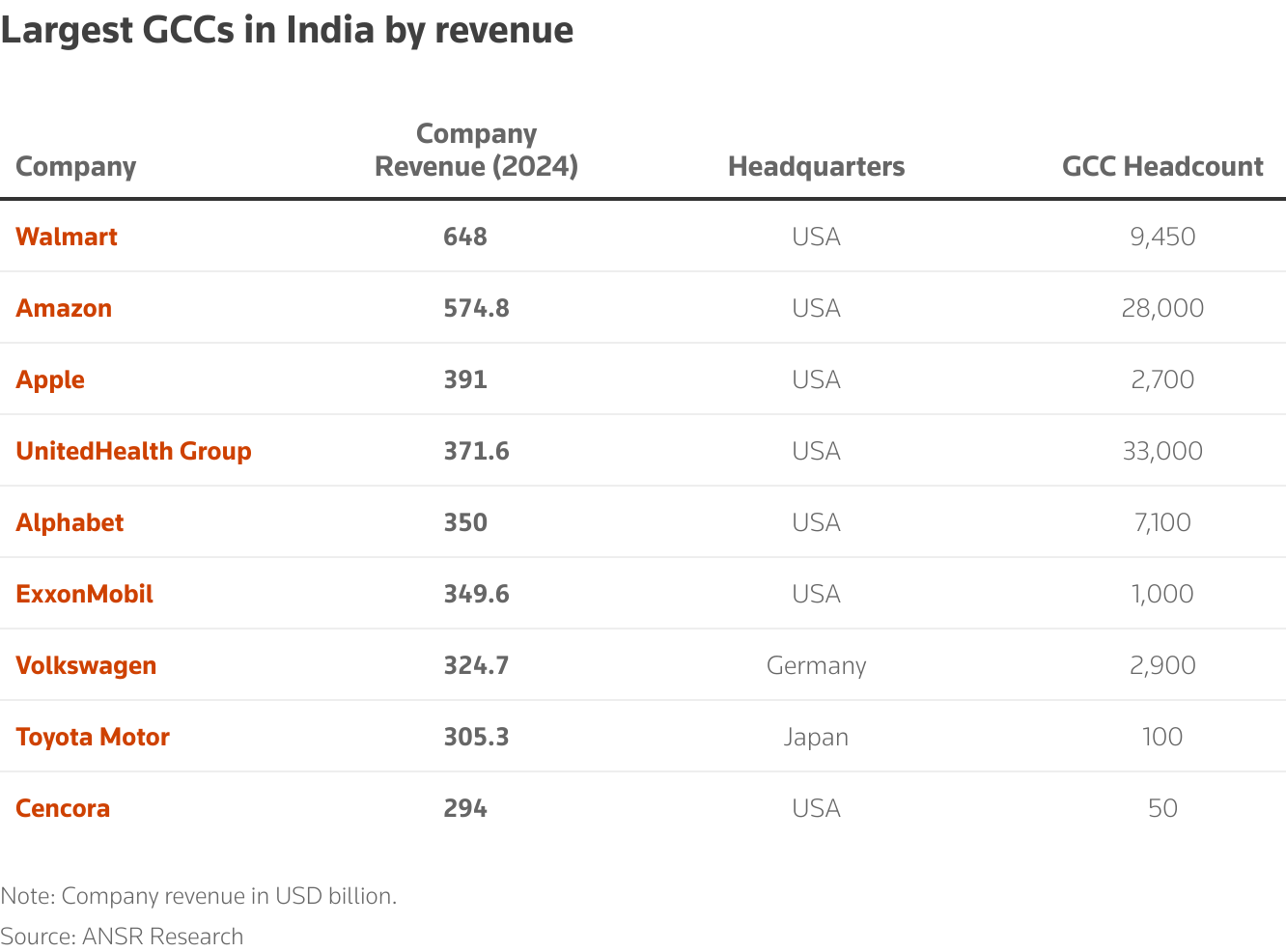

A key piece to the migration of that critical work are global capability centres or GCCs — centres that were once seen as low-cost offshore back offices of foreign companies. But GCCs have now evolved into global companies that act as a backbone for their parent organisations as they handle daily operations, finance, research and development.

In India, the GCC industry is already flourishing. The country is home to more than half of the world's total GCCs and the industry is projected to reach a value of more than $100 billion by 2030. These centres are expected to create at least 2.8 million jobs in the country by the end of the decade. Meanwhile, industry experts say Indian GCCs have also already become hubs of innovation, driving advances in electric vehicles, autonomous driving and hydrogen vehicles.

They also now play a critical role in medicine, enabling drug discovery and development. “India has rapidly evolved from a support base to the very centre of innovation for global pharma and healthcare,” according to consulting firm EY, which said the evolution was largely on the back of GCCs that were handling 70% of finance services, 75% of HR services, 62% of supply chain operations and 67% of IT functions for their global life sciences firms.

Graph via Reuters

The key to India’s hold on the GCC industry is its abundance of capital in the form of well-educated and technologically skilled people. According to the New York Times, India is consistently producing far more English-speaking engineers and scientific specialists than any other country. A commentator described the phenomenon to NYT as “an engineering fetish”.

The widespread availability of labour at low costs has made India the ideal place for foreign forms to “cheaply innovate”, according to EY. Indian GCCs have also developed a reputation of keeping their cost and delivery commitments, while integrating top technologies such as artificial intelligence into their operations.

One top executive at an Indian GCC explained: “AI has grown from a side project into a core part of how we work and create value.” He was speaking at a summit this week for Indian GCCs, around 50% of whom have vowed to prioritise AI as a function within their companies over the next three years.

Commitments such as those have been at the core of the growth of GCCs in India. And Trump’s crusade against the H-1B is only going to accelerate that.

Rohan Lobo, partner and GCC industry leader at Deloitte India, told Reuters this week that he knew of several US firms reassessing their workforce needs and shifting more work to India. "Plans are already underway,” he said. Majority companies planning such a shift were working in financial services and tech, or had exposure to US federal contracts, Lobo added.

If Trump's visa curbs go unchallenged, industry experts expect US firms to shift high-end work tied to AI, product development, cybersecurity, and analytics to their India GCCs, choosing to keep strategic functions in-house over outsourcing, Reuters said. One executive said there was “a sense of urgency" in favour of such a shift. He described the clamour for Indian GCCs as a “gold rush” that “will only get accelerated”.

In other news, Taiwan has shot down a US push to shift half of its semiconductor production in a “chips for protection” deal and said it would never agree to such a proposal. |

| Chipmakers Samsung Electronics and SK Hynix have partnered with OpenAI this week to build two data centres as part of a plan to develop “Stargate Korea”. |

All images via Reuters |

Some hits, some misses

Aside from a boom in GCCs, some also predict Indian technology firms to boost investments at home and tap into India’s tech talent — more of whom may now choose to stay home. "Donald Trump's H1-B fee will choke US innovation, and turbocharge India's,” Amitabh Kant, a nationalist official working with key Indian planning agencies, said. By “slamming the door on global talent” the US would push “the next wave of labs, patents, innovation and startups” to Indian cities, he said.

Key to that could be the steep costs that Indian tech companies working in the US are projected to incur. India’s Economic Times reported the country’s top IT firms could end up paying an extra $150-$550 million in H-1B visa fees. While that would prompt them to increase some hiring in the US, it would also lead them to hire more in India and offshore more operations to the country.

Also, India will not be the only winner of the shift. Asian countries with skilled low-cost labour, like the Philippines, could also benefit. Some firms could also choose to “near-shore” services and move more roles to Canada, Mexico or Colombia. Those countries are also likely to see a jump in GCC activity. In scathing criticism of the new fee, Sequoia Capital’s Chairperson Michael Moritz said in a column in the Financial Times that “much of the work these H-1B visa holders perform can be done as easily in Istanbul, Tallinn, Warsaw, Prague or Bengaluru as in San Francisco, California or Austin, Texas.”

Still, experts say before any of these shifts kick in, India’s $283 billion IT industry and the global services industry on the whole will be in for some pain as clients are likely to delay projects until more clarity on visas or may even ask to reprice them. But insiders also say the US tech industry may be in for more hurt over the longer term. Indian firms will potentially pass on increased visa costs to American clients, and the US could also potentially face labour shortages.

For India’s tech talent, however, more doors could open. This month, China has kickstarted its K-visa programme to attract STEM workers, while Canadian Prime Minister Mark Carney has said he’s planning a proposal to lure in workers that might no longer be welcome in the US. Similar efforts are underway in the UK and Germany, whose ambassador to India, Philipp Ackermann, posted an open call to “highly skilled Indians”, inviting them to apply for “great job opportunities” in the country.

“Our migration policy works a bit like a German car. It is reliable, it is modern, it is predictable.”

Key Numbers 💣️

Sustain-It 🌿

On to some climate news, a new report by the World Economic Forum and Bain & Company says that integrating Asia’s carbon markets will be critical to global net zero goals. The report notes that while Asia accounts for more than half of the world’s carbon emissions and creates 55% of global GDP, its carbon markets cover only 28% of regional emissions. Countries across the Asia Pacific face a climate finance gap of $800 billion on an annual basis — a gap that can be addressed through carbon markets, the report said. China’s ETS market alone could cover 8.7–10.6 billion tonnes of emissions between 2028-2029, the report said, adding that the market could be worth between $56 and 84 billion by 2030.

The Big Quote

"Here’s to the next generation of Indian talent with global exposure and coming back to India and building for the global markets"

Also On Our Radar

Despite its much publicised launch, questions remain around the scope and requirements for China’s new K visa programme.

In a first, Chinese electric vehicle companies invested more in value chains abroad than at home last year.

China is ending its use of European telecom gear in its networks amid a push by President Xi Jinping to replace critical tech infrastructure from the West.

The wave of import tariffs imposed by Trump have sparked a race to sign free-trade agreements around the world and helped seal a range of new business alliances.

And India and China will restart direct flights between designated cities this month effectively ending a 5-year freeze.